Business Cycle Council C D Howe Institute Canada Economic System Information Canadian Authorities Policy

There are numerous sources of business cycle actions corresponding to rapid and vital changes in the value of oil or variation in shopper sentiment that affects total spending in the macroeconomy and thus investment and companies’ profits. Usually such sources are unpredictable upfront and could be considered as random “shocks” to the cyclical sample, as happened in the course of the 2007–2008 monetary crises or the COVID-19 pandemic. In previous decades economists and statisticians have learned an excellent deal about business cycle fluctuations by researching the topic from varied views. Bob Lucas, Nobel Laureate and professor of economics at the University of Chicago talks about wealth and poverty, what affects residing requirements around the globe and over time, the causes of business cycles and the function of the money in our economic system. Along the way, he talks about Jane Jacobs, immigration, and Milton Friedman’s influence on his career. Some models, nonetheless, can gauge how weak or strong the economic system is and date business cycles in real time.

The so-called Juglar cycle has typically been regarded as the true, or main, economic cycle, however several smaller cycles have additionally been identified. According to this concept, the smaller cycles typically coincide with modifications in business inventories, lasting an average of forty months. Other small cycles end result from adjustments within the demand for and supply of explicit agricultural merchandise similar to hogs, cotton, and beef.

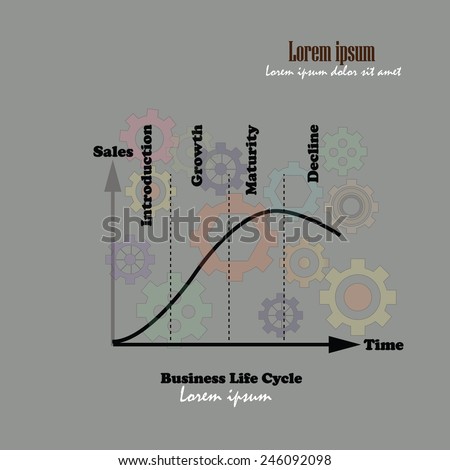

At this level, the financial system experiences adverse financial progress, because the manufacturing of goods and providers decreases and wages reach their lowest point. Regardless of the severity of a business cycle, the trough is all the time the bottom point in relation to economic progress. So, economic expansion usually means that two key financial indicators are increasing—economic output and employment.

Second, local multipliers tend to be extra exactly estimated, partly as a outcome of they make use of a a lot bigger set of information. Please note that there is no uniformity of time among phases, nor is there at all times a chronological development in this order. The NBER’s definition emphasizes that a recession entails a major decline in economic exercise that is spread throughout the economic system and lasts various months. In our interpretation of this definition, we treat the three criteria—depth, diffusion, and duration—as somewhat interchangeable. That is, while every criterion must be met individually to a point, excessive situations revealed by one criterion might partially offset weaker indications from another.

Austrians claim that the boom-and-bust business cycle is attributable to authorities intervention into the economic system, and that the cycle would be comparatively uncommon and gentle without central government interference. For Marx, the economic system primarily based on manufacturing of commodities to be bought in the market is intrinsically prone to disaster. In the lengthy run, these crises are typically more severe and the system will ultimately fail. Another set of models tries to derive the business cycle from political decisions. The political business cycle theory is strongly linked to …

Read more

In determining the chronology of the euro space enterprise cycle, the CEPR Committee adopted a definition of a recession much like that used by the National Bureau of Financial Analysis (NBER) , which has for many years dated the US enterprise cycle. Our method differs from others in the literature in that we follow the composite index method of the Leading Economic Index (LEI) of the United States and concentrate on a small, rigorously selected set of indicators as index elements, and, as well as, our selection criteria target enterprise cycle turning points relatively than financial stress or instability.

In determining the chronology of the euro space enterprise cycle, the CEPR Committee adopted a definition of a recession much like that used by the National Bureau of Financial Analysis (NBER) , which has for many years dated the US enterprise cycle. Our method differs from others in the literature in that we follow the composite index method of the Leading Economic Index (LEI) of the United States and concentrate on a small, rigorously selected set of indicators as index elements, and, as well as, our selection criteria target enterprise cycle turning points relatively than financial stress or instability.  In figuring out the chronology of the euro space business cycle, the CEPR Committee adopted a definition of a recession much like that utilized by the Nationwide Bureau of Financial Analysis (NBER) , which has for a few years dated the US business cycle. The real enterprise cycle idea makes the fundamental assumption that an economy witnesses all these phases of business cycle resulting from technology shocks. Throughout busts the economy is declining, as measured by the decline in real GDP (a common rule of thumb for recession is 2 quarters of detrimental GDP progress).

In figuring out the chronology of the euro space business cycle, the CEPR Committee adopted a definition of a recession much like that utilized by the Nationwide Bureau of Financial Analysis (NBER) , which has for a few years dated the US business cycle. The real enterprise cycle idea makes the fundamental assumption that an economy witnesses all these phases of business cycle resulting from technology shocks. Throughout busts the economy is declining, as measured by the decline in real GDP (a common rule of thumb for recession is 2 quarters of detrimental GDP progress). This journal promotes the change of information and data on theoretical and operational aspects of business cycles, involving each measurement and analysis. Much effort has been expended attempting to develop ways to predict the turning points of business cycles. The business cycle — also known as the financial cycle — refers to fluctuations in financial activity over several months or years. Keynesian fashions do not necessarily indicate periodic enterprise cycles.

This journal promotes the change of information and data on theoretical and operational aspects of business cycles, involving each measurement and analysis. Much effort has been expended attempting to develop ways to predict the turning points of business cycles. The business cycle — also known as the financial cycle — refers to fluctuations in financial activity over several months or years. Keynesian fashions do not necessarily indicate periodic enterprise cycles. The enterprise cycle represents the brief-time period fluctuations in economic development. The trough stage takes place when the economy is popping a nook, with the expansion price still being unfavorable, simply not as unhealthy as before. These fluctuations within the financial activities are termed as phases of business cycles. Gold usually perform greatest in contractions accompanied by uncertainty and a weak U.S. greenback, excessive and accelerating inflation (keep in mind the 1970s?) or low and declining actual interest rates.

The enterprise cycle represents the brief-time period fluctuations in economic development. The trough stage takes place when the economy is popping a nook, with the expansion price still being unfavorable, simply not as unhealthy as before. These fluctuations within the financial activities are termed as phases of business cycles. Gold usually perform greatest in contractions accompanied by uncertainty and a weak U.S. greenback, excessive and accelerating inflation (keep in mind the 1970s?) or low and declining actual interest rates. The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economic system. As a substitute, be certain that your investments are diversified Gradually shift the proportion to stay in tune with the business cycle. This lack of confidence reduces spending and investment within the economic system. The business cycle is the pure rise and fall of economic growth that occurs over time.

The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economic system. As a substitute, be certain that your investments are diversified Gradually shift the proportion to stay in tune with the business cycle. This lack of confidence reduces spending and investment within the economic system. The business cycle is the pure rise and fall of economic growth that occurs over time.