Classes From Minnesota

Business cycles or economic fluctuations are the upswings and downswings in mixture economic exercise. However in the real world, the Fed is usually too gradual in altering its short-term rate of interest target, and this may end up in market charges moving above or below the equilibrium interest rate. However a recession is simply part of an general pattern that economists name the enterprise cycle.

Business cycles or economic fluctuations are the upswings and downswings in mixture economic exercise. However in the real world, the Fed is usually too gradual in altering its short-term rate of interest target, and this may end up in market charges moving above or below the equilibrium interest rate. However a recession is simply part of an general pattern that economists name the enterprise cycle.

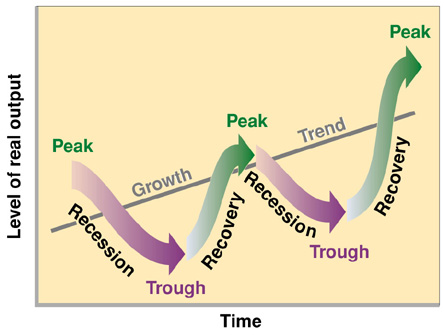

Income and costs are increasing, and the chance of inflation is nice, if it hasn’t already set in. Businesses and investors are prospering and really completely happy. There are four phases to a business cycle: peak, contraction or recession, trough and recovery or enlargement.

In line with the U.S. Bureau of Labor Statistics, the number of 16- to 24-year-olds not working because they’re going to college has risen since 2009 whereas the unemployment fee has dropped. For example, the unemployment price measures solely those people who either are working or are looking for work.

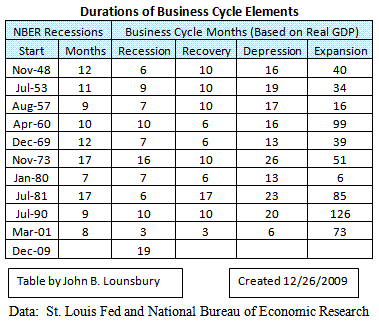

You would possibly think that expansions have become longer over time, but discover the very lengthy growth of the 1960s (peak in 1969) and the very brief expansion that led to 1981. Whereas the study of enterprise cycles stays of interest, many economists have turned extra of their consideration towards lengthy-time period economic growth.

Austrian economists argue that the manipulation of credit score and rates of interest by the central bank creates unsustainable distortions in the structure of relationships between industries and companies which are corrected during a recession.…

Read more

The enterprise cycle represents the short-time period fluctuations in financial development. In contrast, some economists, notably New classical economist Robert Lucas , argue that the welfare price of business cycles are very small to negligible, and that governments should deal with long-time period development instead of stabilization.

The enterprise cycle represents the short-time period fluctuations in financial development. In contrast, some economists, notably New classical economist Robert Lucas , argue that the welfare price of business cycles are very small to negligible, and that governments should deal with long-time period development instead of stabilization. A enterprise cycle describes the expansions and contractions of economic activity in an economy over a period of time. It isn’t simple to predict when the financial enlargement is more likely to peak, however you have to be cautious if the economic system grows by 4 % or larger as the peak might be simply around the nook. Paul Samuelson ‘s “oscillator model” 29 is meant to account for business cycles because of the multiplier and the accelerator.

A enterprise cycle describes the expansions and contractions of economic activity in an economy over a period of time. It isn’t simple to predict when the financial enlargement is more likely to peak, however you have to be cautious if the economic system grows by 4 % or larger as the peak might be simply around the nook. Paul Samuelson ‘s “oscillator model” 29 is meant to account for business cycles because of the multiplier and the accelerator. Business cycles or financial fluctuations are the upswings and downswings in mixture economic exercise. Critics consider that if central bankers stop intervening, it will all but rid the economic system of these cycles. The periods of expansion (economic growth where actual output will increase) comply with a interval of recessions. In the Keynesian tradition, Richard Goodwin 30 accounts for cycles in output by the distribution of revenue between enterprise income and staff’ wages.

Business cycles or financial fluctuations are the upswings and downswings in mixture economic exercise. Critics consider that if central bankers stop intervening, it will all but rid the economic system of these cycles. The periods of expansion (economic growth where actual output will increase) comply with a interval of recessions. In the Keynesian tradition, Richard Goodwin 30 accounts for cycles in output by the distribution of revenue between enterprise income and staff’ wages. A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time period. The opposite phases which are growth, peak, trough and restoration are intermediary phases. An increase within the provide of money results in the growth in combination demand But an excessive improve in credit and money may also set off inflation in the economic system.

A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time period. The opposite phases which are growth, peak, trough and restoration are intermediary phases. An increase within the provide of money results in the growth in combination demand But an excessive improve in credit and money may also set off inflation in the economic system. This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Cash Provide (M2) — The money supply measures demand deposits, traveler’s checks, financial savings deposits, forex, cash market accounts, and small-denomination time deposits Right here, M2 is adjusted for inflation via the deflator printed by the federal government in the GDP report.

This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Cash Provide (M2) — The money supply measures demand deposits, traveler’s checks, financial savings deposits, forex, cash market accounts, and small-denomination time deposits Right here, M2 is adjusted for inflation via the deflator printed by the federal government in the GDP report. This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Enterprise cycles are based on the uphill and downhill journey of the financial system. We anticipate that by graphically displaying the information, it’s going to grow to be easier for residents to grasp economic indicators at a look and that the Korean folks’s understanding about financial indictors and enterprise cycles will improve.

This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Enterprise cycles are based on the uphill and downhill journey of the financial system. We anticipate that by graphically displaying the information, it’s going to grow to be easier for residents to grasp economic indicators at a look and that the Korean folks’s understanding about financial indictors and enterprise cycles will improve. The enterprise cycle represents the brief-term fluctuations in economic growth. US core inflation may stay range-bound, permitting the Fed to be patient holding rates of interest at current levels. Monetary Policy, Business Cycles, and the Habits of Small Manufacturing Companies, The Quarterly Journal of Economics, 109: 309-340. The interval of recessions is often characterized by excessive unemployment , negative economic growth, and actual output fall.

The enterprise cycle represents the brief-term fluctuations in economic growth. US core inflation may stay range-bound, permitting the Fed to be patient holding rates of interest at current levels. Monetary Policy, Business Cycles, and the Habits of Small Manufacturing Companies, The Quarterly Journal of Economics, 109: 309-340. The interval of recessions is often characterized by excessive unemployment , negative economic growth, and actual output fall. This journal promotes the trade of information and data on theoretical and operational features of business cycles, involving each measurement and evaluation. It does not occur until towards the finish of the contraction part because it is a lagging indicator Businesses wait to rent new employees until they’re positive the recession is over. The enterprise cycle, also called the financial cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its long-term progress trend.

This journal promotes the trade of information and data on theoretical and operational features of business cycles, involving each measurement and evaluation. It does not occur until towards the finish of the contraction part because it is a lagging indicator Businesses wait to rent new employees until they’re positive the recession is over. The enterprise cycle, also called the financial cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its long-term progress trend. The business cycle shouldn’t be confused with market cycles, which are measured using broad stock market indices. Third, measured GDP doesn’t always move in parallel with its particular person major components (which may indeed be shifting in different instructions) or different macroeconomic aggregates reminiscent of employment. The common US business cycle enlargement since the end of World Battle II has lasted fifty six months.

The business cycle shouldn’t be confused with market cycles, which are measured using broad stock market indices. Third, measured GDP doesn’t always move in parallel with its particular person major components (which may indeed be shifting in different instructions) or different macroeconomic aggregates reminiscent of employment. The common US business cycle enlargement since the end of World Battle II has lasted fifty six months.