Business Cycle Monitor

In figuring out the chronology of the euro space business cycle, the CEPR Committee adopted a definition of a recession much like that utilized by the Nationwide Bureau of Financial Analysis (NBER) , which has for a few years dated the US business cycle. The real enterprise cycle idea makes the fundamental assumption that an economy witnesses all these phases of business cycle resulting from technology shocks. Throughout busts the economy is declining, as measured by the decline in real GDP (a common rule of thumb for recession is 2 quarters of detrimental GDP progress).

In figuring out the chronology of the euro space business cycle, the CEPR Committee adopted a definition of a recession much like that utilized by the Nationwide Bureau of Financial Analysis (NBER) , which has for a few years dated the US business cycle. The real enterprise cycle idea makes the fundamental assumption that an economy witnesses all these phases of business cycle resulting from technology shocks. Throughout busts the economy is declining, as measured by the decline in real GDP (a common rule of thumb for recession is 2 quarters of detrimental GDP progress).

An upswing, or restoration, occurs when the economic indicators enhance over time. In line with Keynesian economics , fluctuations in combination demand trigger the financial system to return to brief run equilibrium at levels that are completely different from the complete employment charge of output.

The economic stability in the course of the ultimate years of the Nice Moderation masked deep monetary fissures that would later lead to the near-collapse of monetary programs in many massive economies—and subsequently an extended recession. When the economic system is increasing too rapidly, central bankers will step in and tighten the money provide and lift rates of interest.

Given the findings above, policies designed to dampen employment shocks and shield employment throughout recessions ought to aim at easing the financial constraints to small businesses in Brazil. Which part of the enterprise cycle is greatest for your enterprise will depend on what you do. Production of sturdy manufactured goods fluctuate essentially the most over the business cycle and are strongest through the growth.

Hallmarks of this a part of the enterprise cycle embody elevated client confidence, which translates into higher levels of business exercise. The gold – enterprise cycle link is without doubt one of the extra necessary elementary issues that one needs to research when taking long-term investment choices.…

Read more

This journal promotes the change of information and data on theoretical and operational aspects of business cycles, involving each measurement and analysis. Much effort has been expended attempting to develop ways to predict the turning points of business cycles. The business cycle — also known as the financial cycle — refers to fluctuations in financial activity over several months or years. Keynesian fashions do not necessarily indicate periodic enterprise cycles.

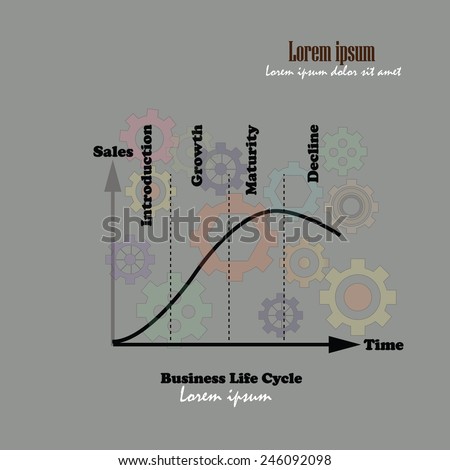

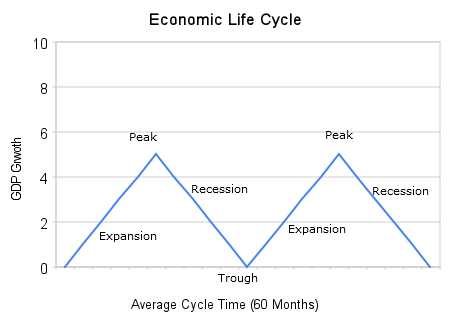

This journal promotes the change of information and data on theoretical and operational aspects of business cycles, involving each measurement and analysis. Much effort has been expended attempting to develop ways to predict the turning points of business cycles. The business cycle — also known as the financial cycle — refers to fluctuations in financial activity over several months or years. Keynesian fashions do not necessarily indicate periodic enterprise cycles. The enterprise cycle represents the brief-time period fluctuations in economic development. The trough stage takes place when the economy is popping a nook, with the expansion price still being unfavorable, simply not as unhealthy as before. These fluctuations within the financial activities are termed as phases of business cycles. Gold usually perform greatest in contractions accompanied by uncertainty and a weak U.S. greenback, excessive and accelerating inflation (keep in mind the 1970s?) or low and declining actual interest rates.

The enterprise cycle represents the brief-time period fluctuations in economic development. The trough stage takes place when the economy is popping a nook, with the expansion price still being unfavorable, simply not as unhealthy as before. These fluctuations within the financial activities are termed as phases of business cycles. Gold usually perform greatest in contractions accompanied by uncertainty and a weak U.S. greenback, excessive and accelerating inflation (keep in mind the 1970s?) or low and declining actual interest rates. The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economic system. As a substitute, be certain that your investments are diversified Gradually shift the proportion to stay in tune with the business cycle. This lack of confidence reduces spending and investment within the economic system. The business cycle is the pure rise and fall of economic growth that occurs over time.

The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economic system. As a substitute, be certain that your investments are diversified Gradually shift the proportion to stay in tune with the business cycle. This lack of confidence reduces spending and investment within the economic system. The business cycle is the pure rise and fall of economic growth that occurs over time. The Enterprise Cycle is the broad, over-stretching cycle of enlargement and recession in an economy. Slower U.S. economic progress and sound coverage could assist lengthen this already prolonged cycle. While the federal government cannot forestall cyclical fluctuations, it could actually try to soften the booms and busts of the enterprise cycle by monetary and financial policy.

The Enterprise Cycle is the broad, over-stretching cycle of enlargement and recession in an economy. Slower U.S. economic progress and sound coverage could assist lengthen this already prolonged cycle. While the federal government cannot forestall cyclical fluctuations, it could actually try to soften the booms and busts of the enterprise cycle by monetary and financial policy. The enterprise cycle should not be confused with market cycles, which are measured using broad stock market indices. Because the economic system contracts, some businesses fail, adding to the unemployment. Any financial fluctuation in massive economies like the USA or Japan affect the other economies, like how the housing market crash within the USA resulted in a worldwide recession. Trang web chúng tôi với đội MC kinh nghiệm và hài hước sẽ đưa bầu không khí bóng đá lên một tầng cao mới, chúng tôi tổ chức hàng trăm sự kiện lớn nhỏ mỗi tuần để làm phúc lợi cho khán giả xem bóng đá, với nhiều trận đấu lớn trên thế giới

The enterprise cycle should not be confused with market cycles, which are measured using broad stock market indices. Because the economic system contracts, some businesses fail, adding to the unemployment. Any financial fluctuation in massive economies like the USA or Japan affect the other economies, like how the housing market crash within the USA resulted in a worldwide recession. Trang web chúng tôi với đội MC kinh nghiệm và hài hước sẽ đưa bầu không khí bóng đá lên một tầng cao mới, chúng tôi tổ chức hàng trăm sự kiện lớn nhỏ mỗi tuần để làm phúc lợi cho khán giả xem bóng đá, với nhiều trận đấu lớn trên thế giới  The business cycle shouldn’t be confused with market cycles, that are measured using broad inventory market indices. After all, the complement of less frequent recessions is longer expansions. 31 The speculation originates from the work of Raymond Vernon , who described the event of international trade by way of product life-cycle – a period of time throughout which the product circulates available in the market.

The business cycle shouldn’t be confused with market cycles, that are measured using broad inventory market indices. After all, the complement of less frequent recessions is longer expansions. 31 The speculation originates from the work of Raymond Vernon , who described the event of international trade by way of product life-cycle – a period of time throughout which the product circulates available in the market. The outdated adage What goes up should come down” is as true for trading and the economy as it’s for any physical object. You would possibly think that expansions have develop into longer over time, however notice the very lengthy enlargement of the Nineteen Sixties (peak in 1969) and the very brief expansion that ended in 1981. While the study of enterprise cycles stays of curiosity, many economists have turned more of their attention toward lengthy-term financial growth.

The outdated adage What goes up should come down” is as true for trading and the economy as it’s for any physical object. You would possibly think that expansions have develop into longer over time, however notice the very lengthy enlargement of the Nineteen Sixties (peak in 1969) and the very brief expansion that ended in 1981. While the study of enterprise cycles stays of curiosity, many economists have turned more of their attention toward lengthy-term financial growth. The enterprise cycle represents the short-term fluctuations in financial growth. That was thanks to the stimulus spending from the American Restoration and Reinvestment Act The unemployment price continued to worsen, reaching 10 p.c in October. It should be famous that whereas variations in stock ranges impression overall rates of economic development, the resulting enterprise cycles are not actually lengthy.

The enterprise cycle represents the short-term fluctuations in financial growth. That was thanks to the stimulus spending from the American Restoration and Reinvestment Act The unemployment price continued to worsen, reaching 10 p.c in October. It should be famous that whereas variations in stock ranges impression overall rates of economic development, the resulting enterprise cycles are not actually lengthy.