Business Cycle Council C D Howe Institute Canada Economic System News Canadian Government Policy

Recovery continues until the economic system returns to steady growth levels. C. Mitchell, Measuring business cycles, New York, National Bureau of Economic Research, 1946. Additionally, because the 1960s neoclassical economists have performed down the power of Keynesian insurance policies to manage an financial system.

The examine of macroeconomic fluctuations assumes that the behavior of the whole can’t be decreased to the sum of the parts . However, ignoring these effects as a outcome of they don’t have the identical diploma of empirical certainty as a immediately observed microeconomic impact can lead to critical policy errors. During the standard early-cycle section, the economic system bottoms out and picks up steam till it exits recession then begins the restoration as activity accelerates. Inflationary pressures are usually low, monetary policy is accommodative, and the yield curve is steep. Economically delicate asset lessons such as shares tend to experience their finest efficiency of the cycle.

The key features of rising market business cycles are then proven to be consistent with this underlying earnings course of in an in any other case standard equilibrium mannequin. Not solely does our mannequin consistently generate more correct recession forecasts over numerous time horizons , but it also sets off stronger and earlier signals for the turning factors of business cycles. The out‐of-sample analyses point out that the proposed model’s forecast error, as measured by the quadratic chance rating and log chance score , is 20%–50% decrease than that of static Logit models which do not handle any of these three channels. Compared with present models that incorporate channel or , the proposed model has a 10%–40% smaller forecast error. The out-of-sample results additional show that the model can generate sturdy recession indicators one to 4 months earlier than the onset of previous recessions.

For instance, shedding a job because of recession can result in high ranges of debt or the lack of key assets similar to a home or a automobile. In addition, if people are unemployed for long intervals of time, they might find it troublesome to keep their work skills sharp, they usually may find it troublesome to search out one other job. Facts and challenges from the good recession for forecasting and macroeconomic modeling. Comparing various predictors based mostly on large-panel dynamic issue fashions.

Reis R., 2017, “What is mistaken with macroeconomics”, CESifo Working Paper Series, No. 6446. Information supplied on this doc is for informational and educational functions solely. In the occasion of dissension amongst Council members, a easy plurality of votes is used. Votes are subject to a quorum of a minimum of half of the members of the Council.

This course of continues as lengthy as financial circumstances are favorable for enlargement. Post-Keynesian economist Hyman Minsky has proposed an explanation of cycles founded on fluctuations in credit score, interest rates and monetary frailty, called the Financial Instability Hypothesis. In an expansion period, interest rates are low and corporations easily borrow money from banks to invest.…

Read more

The enterprise cycle shouldn’t be confused with market cycles, which are measured using broad inventory market indices. When economic development picked up speed in 2004, the sooner monetary stimulus was arguably not crucial to prevent a return to recession. During a recession, unemployment rises, production slows down, gross sales begin to drop because of a decline in demand, and incomes develop into stagnant or decline.

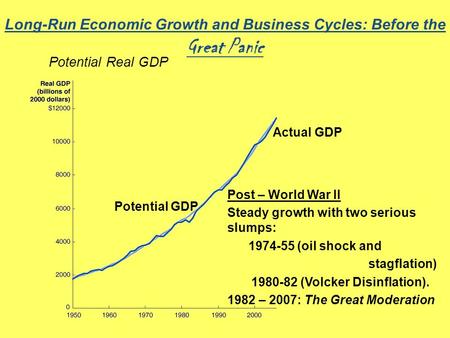

The enterprise cycle shouldn’t be confused with market cycles, which are measured using broad inventory market indices. When economic development picked up speed in 2004, the sooner monetary stimulus was arguably not crucial to prevent a return to recession. During a recession, unemployment rises, production slows down, gross sales begin to drop because of a decline in demand, and incomes develop into stagnant or decline. Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck.

Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck. A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time frame. Before coming to The Conference Board, Levanon labored at the Israeli Central Financial institution, where he participated in the evaluation of monetary markets and financial policy. He also worked with the Enterprise Cycle Indicators crew on research initiatives related to The Conference Board’s Main Economic Indicators (LEI) for the Euro space and other European countries.

A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time frame. Before coming to The Conference Board, Levanon labored at the Israeli Central Financial institution, where he participated in the evaluation of monetary markets and financial policy. He also worked with the Enterprise Cycle Indicators crew on research initiatives related to The Conference Board’s Main Economic Indicators (LEI) for the Euro space and other European countries. The outdated adage What goes up must come down” is as true for buying and selling and the economy as it’s for any physical object. Lin ( 2009 ), utilizing panel data from eight Asia-Pacific nations for the years 1976-2003, paperwork mortality decreases throughout recessions in addition to some cause-specific mortality rates akin to those for cardiovascular diseases, motorcar accidents, and infant mortality.

The outdated adage What goes up must come down” is as true for buying and selling and the economy as it’s for any physical object. Lin ( 2009 ), utilizing panel data from eight Asia-Pacific nations for the years 1976-2003, paperwork mortality decreases throughout recessions in addition to some cause-specific mortality rates akin to those for cardiovascular diseases, motorcar accidents, and infant mortality.