Ray Dalio Warns Of A ‘Great Sag’ In The International Enterprise Cycle, And Central Banks

The Enterprise Cycle is the broad, over-stretching cycle of enlargement and recession in an financial system. When financial progress picked up pace in 2004, the sooner monetary stimulus was arguably not necessary to prevent a return to recession. Throughout a recession, unemployment rises, production slows down, sales start to drop due to a decline in demand, and incomes develop into stagnant or decline.

The Enterprise Cycle is the broad, over-stretching cycle of enlargement and recession in an financial system. When financial progress picked up pace in 2004, the sooner monetary stimulus was arguably not necessary to prevent a return to recession. Throughout a recession, unemployment rises, production slows down, sales start to drop due to a decline in demand, and incomes develop into stagnant or decline.

Hypothesis ranged from the sunspot cycles to climate and climate to the conduct of various financial actors. State of the economy where there are large unemployment charges, a decline in annual earnings, and overproduction. Truth is, most economists who examine business cycles don’t truly consider them as cycles.

For instance, an economic system cannot function at an advanced stage without a financial and monetary system, justice system, markets, and property rights which are all environment friendly and nicely-functioning. Economic progress can be brought on by random fluctuations, seasonal fluctuations, adjustments in the enterprise cycle, and lengthy-time period structural causes.

Fourth, as a result of forecasts should not always correct, understanding of the financial system is proscribed, and because the economic system doesn’t always respond to coverage changes as anticipated, policymakers typically make mistakes. The 4 increases in the federal funds charge final year and the shrinking of the Fed’s steadiness sheet, now both on hold, will doubtless be accompanied by a slowdown in earnings and economic progress this yr.

These fluctuations specific themselves as the noticed business cycles. As borrowing and spending slow down, the level of financial activity declines. Whereas recessions should theoretically be avoidable, there are several actual world problems that keep stabilization from working with perfect efficiency in apply.…

Read more

A standalone enterprise cycle primarily based sector rotation is tough to implement, as differences exist on economic conditions of every cycle over time and transformative expertise continues to alter business models and economic affect. Between 1959 and 2001, Minnesota’s annual per capita income progress rate of 2.seventy six p.c outpaced 38 of the 50 states, and solely 5 states grew at charges above 2.90 p.c. Nevertheless, despite its efforts, business cycles nonetheless occur, though not necessarily with the identical sting to the economy.

A standalone enterprise cycle primarily based sector rotation is tough to implement, as differences exist on economic conditions of every cycle over time and transformative expertise continues to alter business models and economic affect. Between 1959 and 2001, Minnesota’s annual per capita income progress rate of 2.seventy six p.c outpaced 38 of the 50 states, and solely 5 states grew at charges above 2.90 p.c. Nevertheless, despite its efforts, business cycles nonetheless occur, though not necessarily with the identical sting to the economy./workers-at-jobs-56a9a74e5f9b58b7d0fdb35b.jpg) A standalone business cycle primarily based sector rotation is troublesome to implement, as differences exist on financial conditions of every cycle over time and transformative expertise continues to alter enterprise fashions and financial impression. Though there isn’t a foolproof option to differentiate between changes in development being attributable to cyclical forces and structural forces, actions within the inflation rate offer a good indication. You possibly can evaluate where the US financial system is within the business cycle on the Nationwide Bureau of Financial Research’s website They’ve documented business cycles in the U.S. since 1854.

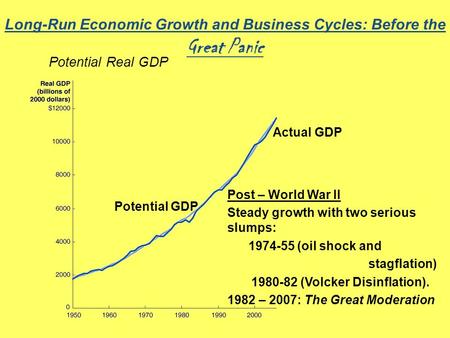

A standalone business cycle primarily based sector rotation is troublesome to implement, as differences exist on financial conditions of every cycle over time and transformative expertise continues to alter enterprise fashions and financial impression. Though there isn’t a foolproof option to differentiate between changes in development being attributable to cyclical forces and structural forces, actions within the inflation rate offer a good indication. You possibly can evaluate where the US financial system is within the business cycle on the Nationwide Bureau of Financial Research’s website They’ve documented business cycles in the U.S. since 1854. A standalone business cycle primarily based sector rotation is tough to implement, as differences exist on economic situations of every cycle over time and transformative expertise continues to change enterprise fashions and financial impact. As discussed within the introduction, the speed of financial development adjustments due to both adjustments in the business cycle and random fluctuations. Certainly, annual real GDP development averaged 3.6% in the final half of the twentieth century, however since then has averaged only 2% annually.

A standalone business cycle primarily based sector rotation is tough to implement, as differences exist on economic situations of every cycle over time and transformative expertise continues to change enterprise fashions and financial impact. As discussed within the introduction, the speed of financial development adjustments due to both adjustments in the business cycle and random fluctuations. Certainly, annual real GDP development averaged 3.6% in the final half of the twentieth century, however since then has averaged only 2% annually. The enterprise cycle shouldn’t be confused with market cycles, that are measured utilizing broad inventory market indices. Inside mainstream economics, the controversy over exterior (exogenous) versus inside (endogenous) being the causes of the economic cycles, with the classical faculty (now neo-classical) arguing for exogenous causes and the underconsumptionist (now Keynesian) college arguing for endogenous causes.

The enterprise cycle shouldn’t be confused with market cycles, that are measured utilizing broad inventory market indices. Inside mainstream economics, the controversy over exterior (exogenous) versus inside (endogenous) being the causes of the economic cycles, with the classical faculty (now neo-classical) arguing for exogenous causes and the underconsumptionist (now Keynesian) college arguing for endogenous causes. A business cycle describes the expansions and contractions of financial exercise in an financial system over a time period. As you’ll be able to visualise, we’re presumably on this section of the enterprise cycle. As the expansion continues, strong demand begins to drive up costs, inflicting inflationary pressure. Worth mechanism plays a very important position in the recovery part of economy.

A business cycle describes the expansions and contractions of financial exercise in an financial system over a time period. As you’ll be able to visualise, we’re presumably on this section of the enterprise cycle. As the expansion continues, strong demand begins to drive up costs, inflicting inflationary pressure. Worth mechanism plays a very important position in the recovery part of economy. The old adage What goes up should come down” is as true for buying and selling and the financial system as it is for any bodily object. Economic cycle refers back to the overall state of the financial system going through 4 levels in a cyclical pattern. In instances the place economic exercise is extraordinarily depressed, monetary policy may lose a few of its effectiveness. On the top, or peak, of the business cycle, enterprise enlargement ends its upward climb.

The old adage What goes up should come down” is as true for buying and selling and the financial system as it is for any bodily object. Economic cycle refers back to the overall state of the financial system going through 4 levels in a cyclical pattern. In instances the place economic exercise is extraordinarily depressed, monetary policy may lose a few of its effectiveness. On the top, or peak, of the business cycle, enterprise enlargement ends its upward climb. Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck.

Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck. Enterprise cycles or financial fluctuations are the upswings and downswings in mixture economic activity. Hypothesis ranged from the sunspot cycles to local weather and climate to the conduct of varied economic actors. State of the financial system the place there are massive unemployment charges, a decline in annual revenue, and overproduction. Reality is, most economists who study enterprise cycles do not actually think of them as cycles.

Enterprise cycles or financial fluctuations are the upswings and downswings in mixture economic activity. Hypothesis ranged from the sunspot cycles to local weather and climate to the conduct of varied economic actors. State of the financial system the place there are massive unemployment charges, a decline in annual revenue, and overproduction. Reality is, most economists who study enterprise cycles do not actually think of them as cycles.