Business Cycle Council C D Howe Institute Canada Economic System News Canadian Authorities Coverage

It would be much easier to plan for the future if recessions have been easy to predict, but they aren’t. The Federal Reserve has a job to play in smoothing the rough spots out of the business cycle. The Fed makes use of its financial policy tools to promote most employment and worth stability within the economy.

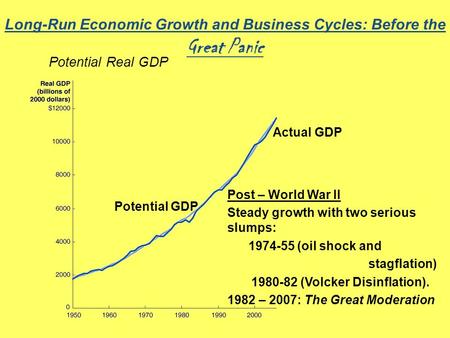

This caused economists to maneuver away from viewing business cycles as a cycle that wanted to be explained and instead viewing their apparently cyclical nature as a methodological artefact. This signifies that what look like cyclical phenomena can truly be defined as simply random events which are fed into a simple linear mannequin. Thus business cycles are basically random shocks that common out over time. Mainstream economists have built fashions of business cycles primarily based the idea that they are caused by random shocks. There has been some resurgence of neoclassical approaches within the form of actual business cycle theory. Business cycles in OECD countries after World War II were usually more restrained than the earlier business cycles.

Commodity price shocks are thought-about to be a significant driving drive of the US business cycle. House prices and unemployment moved from the green to the orange quadrant. In the course of July, new data have become obtainable for all month-to-month indicators. As a end result, the distribution of the indications across and within the quadrants has modified.

Thus, by raising or decreasing interest rates, the Federal Reserve is ready to generate recessions or booms. He felt that the crisis was a temporary swing of the business cycle and that the economy would quickly get well with out authorities intervention. Specifically, he has been concerned with how the federal government’s monetary and financial instruments ought to reply to shocks over the business cycle. As the external market conditions change following the general business cycle, so does performance of investments.

First, output should respond in a method or one other to combination demand . Second, labor-market flows and the unemployment threat that they generate must reply endogenously to output changes; this requires a illustration of the labor market in terms of worker flows and never merely by way of stock . Finally, and perhaps most importantly, households must be imperfectly insured against the chance of unemployment – otherwise there could be no precautionary motive in the first place and subsequently no time-variations in precautionary savings. These three mechanisms are current in various varieties, and thus generate the precautionary-saving spiral, in the works of Challe et al. , Chamley , Den Haan et al. , Heathcote and Perri , Ravn and Sterk and Werning , among others. In this stage, there is a rise in positive economic indicators similar to employment, revenue, output, wages, earnings, demand, and supply of products and companies. Debtors are usually paying their debts on time, the velocity of the money supply is excessive, and funding is high.

The committee makes a separate willpower of the calendar quarter of a peak or trough, …

Read more

The enterprise cycle shouldn’t be confused with market cycles, which are measured using broad inventory market indices. When economic development picked up speed in 2004, the sooner monetary stimulus was arguably not crucial to prevent a return to recession. During a recession, unemployment rises, production slows down, gross sales begin to drop because of a decline in demand, and incomes develop into stagnant or decline.

The enterprise cycle shouldn’t be confused with market cycles, which are measured using broad inventory market indices. When economic development picked up speed in 2004, the sooner monetary stimulus was arguably not crucial to prevent a return to recession. During a recession, unemployment rises, production slows down, gross sales begin to drop because of a decline in demand, and incomes develop into stagnant or decline. Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck.

Business cycles or economic fluctuations are the upswings and downswings in aggregate economic exercise. Over the course of the enterprise cycle, aggregate spending might be anticipated to be too excessive as usually as it is too low. Inflation is extra of a threat throughout peak intervals as a result of employment and earnings are at excessive levels. In latest decades, expansions have develop into longer and recessions shallower, maybe due to improved stabilization coverage, or perhaps because of good luck. A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time frame. Before coming to The Conference Board, Levanon labored at the Israeli Central Financial institution, where he participated in the evaluation of monetary markets and financial policy. He also worked with the Enterprise Cycle Indicators crew on research initiatives related to The Conference Board’s Main Economic Indicators (LEI) for the Euro space and other European countries.

A enterprise cycle describes the expansions and contractions of financial activity in an economy over a time frame. Before coming to The Conference Board, Levanon labored at the Israeli Central Financial institution, where he participated in the evaluation of monetary markets and financial policy. He also worked with the Enterprise Cycle Indicators crew on research initiatives related to The Conference Board’s Main Economic Indicators (LEI) for the Euro space and other European countries.