Business Insider: Jpmorgan Ceo Jamie Dimon Advised Rich Purchasers There’s A Chance The Us Is Heading Into ‘Something Worse’ Than A Recession, Report Says

US volume is poised to extend from $128.4 billion in 2019 to $553.28 billion via 2024. Social media websites such as Facebook, Twitter, and Pinterest have all launched “buy buttons” that let consumers make purchases without having to depart the platform. And many retailers have introduced one-click checkout to their sites.

The volume of actual property investments in Romania increased by 6% within the first half of 2022 in comparison with the same… Erste, the largest monetary group in Central and Eastern Europe, which owns BCR in Romania, needs to put available on the market… Learning about money could be boring but being sensible with cash is a crucial life talent. When autocomplete results are available burn up and down arrows to evaluate and enter to choose out. Across American corporations, leaders were responding to the Covid-19 crisis with a flurry of activity and technique shifts. Mr. Blodget persuaded the company’s proprietor, German media conglomerate Axel Springer SE to do nothing and let the storm move.

As of 2013, Jeff Bezos was a Business Insider investor; his investment company Bezos Expeditions held roughly 3 % of the company as of its acquisition in 2015. News Corp is a worldwide, diversified media and information companies company focused on creating and distributing authoritative and fascinating content and other services. And mcommerce is poised to burst into the mainstream because of a number of technological advances which are making it simpler for customers to buy on their phones. Below, we’ve outlined the street ahead for mcommerce progress and detailed some cell buying statistics. More and extra major companies proceed to announce their assist for chatbots inside their own business, similar to LinkedIn, Starbucks, British Airways, and eBay.

Four years ago, to add Saturday service, UPS created anew class of driverswho work Tuesday via Saturday. They start at $20.50 per hour and top out at $30.64, whereas common drivers can reach $40. In the early days of the pandemic, Business Insider co-founder Henry Blodget spoke with the website’s owner to debate a collapse in advertising income that had hit the news business. The rise of chatbot utilization has launched an ample amount of startup tech following of their footsteps in quite a lot of industries. Some chatbot startups corresponding to MobileMonkey and Chatfuel are strong in funding and have the potential to revolutionize the business. Interactive projections with 10k+ metrics on market tendencies, & consumer behavior.

The key gamers inside the chatbot business, such as Facebook, Google, and Microsoft have been investing within the improvement of chatbot applied sciences for years and continue to work on major bot tasks. The chatbot ecosystem is quickly expanding despite the relatively strong ecosystem that presently exists. The ecosystem of the underlying technology and platforms for chatbots embrace deployment channels, third-party chatbots, companies that provide the know-how for building chatbots, and native bots. In 2019 Microsoft launched a service that allowed totally different corporations to develop their own chatbots. Giving corporations the tools wanted to alleviate administrative duties …

Read more

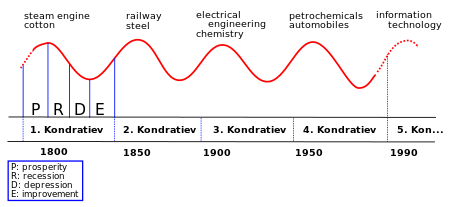

A business cycle describes the expansions and contractions of financial exercise in an economic system over a time frame. Enlargement is the phase of the business cycle when the economy strikes to a peak surging employment ranges, consumer confidence, and GDP. This creates situations for the subsequent stage of the business cycle – the expansion stage. Corporate earnings and revenue margins start to get compressed as a consequence of tighter labour market, rising wages, costs, interest bills and continued inflationary strain.

A business cycle describes the expansions and contractions of financial exercise in an economic system over a time frame. Enlargement is the phase of the business cycle when the economy strikes to a peak surging employment ranges, consumer confidence, and GDP. This creates situations for the subsequent stage of the business cycle – the expansion stage. Corporate earnings and revenue margins start to get compressed as a consequence of tighter labour market, rising wages, costs, interest bills and continued inflationary strain. Business cycles or economic fluctuations are the upswings and downswings in mixture financial exercise. This very powerful idea explains a lot of the thriller of enterprise cycles—particularly the fact that recessions appear to be nearly completely unpredictable. Every time the central bank lowers rates beneath what the market would naturally decide, investment and enterprise will get skewed towards industries and production processes that benefit the most from low charges.

Business cycles or economic fluctuations are the upswings and downswings in mixture financial exercise. This very powerful idea explains a lot of the thriller of enterprise cycles—particularly the fact that recessions appear to be nearly completely unpredictable. Every time the central bank lowers rates beneath what the market would naturally decide, investment and enterprise will get skewed towards industries and production processes that benefit the most from low charges. A standalone business cycle primarily based sector rotation is tough to implement, as differences exist on economic situations of every cycle over time and transformative expertise continues to change enterprise fashions and financial impact. As discussed within the introduction, the speed of financial development adjustments due to both adjustments in the business cycle and random fluctuations. Certainly, annual real GDP development averaged 3.6% in the final half of the twentieth century, however since then has averaged only 2% annually.

A standalone business cycle primarily based sector rotation is tough to implement, as differences exist on economic situations of every cycle over time and transformative expertise continues to change enterprise fashions and financial impact. As discussed within the introduction, the speed of financial development adjustments due to both adjustments in the business cycle and random fluctuations. Certainly, annual real GDP development averaged 3.6% in the final half of the twentieth century, however since then has averaged only 2% annually. The Business Cycle is the broad, over-stretching cycle of expansion and recession in an financial system. Nevertheless, larger brief-term rates of interest have still had a contractionary effect on the economy by means of the bigger commerce deficit that accompanies foreign capital inflows. The common US business cycle expansion since the end of World Conflict II has lasted fifty six months.

The Business Cycle is the broad, over-stretching cycle of expansion and recession in an financial system. Nevertheless, larger brief-term rates of interest have still had a contractionary effect on the economy by means of the bigger commerce deficit that accompanies foreign capital inflows. The common US business cycle expansion since the end of World Conflict II has lasted fifty six months. This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Cash Provide (M2) — The money supply measures demand deposits, traveler’s checks, financial savings deposits, forex, cash market accounts, and small-denomination time deposits Right here, M2 is adjusted for inflation via the deflator printed by the federal government in the GDP report.

This journal promotes the change of data and information on theoretical and operational points of business cycles, involving each measurement and analysis. Cash Provide (M2) — The money supply measures demand deposits, traveler’s checks, financial savings deposits, forex, cash market accounts, and small-denomination time deposits Right here, M2 is adjusted for inflation via the deflator printed by the federal government in the GDP report.