Courting The Enterprise Cycle

The enterprise cycle represents the short-term fluctuations in economic development. For example, an investor may choose to spend money on commodities and know-how shares at the finish of the enterprise cycle because they may be low cost, and then sell them during the early a part of an enlargement. The CEPR Committee views real GDP (euro area mixture, in addition to national) as the primary measure of macroeconomic activity, however it also appears to be like at additional macroeconomic variables, for a number of reasons.

The enterprise cycle represents the short-term fluctuations in economic development. For example, an investor may choose to spend money on commodities and know-how shares at the finish of the enterprise cycle because they may be low cost, and then sell them during the early a part of an enlargement. The CEPR Committee views real GDP (euro area mixture, in addition to national) as the primary measure of macroeconomic activity, however it also appears to be like at additional macroeconomic variables, for a number of reasons.

This division isn’t absolute – some classicals (together with Say) argued for presidency coverage to mitigate the harm of financial cycles, despite believing in external causes, whereas Austrian Faculty economists argue against authorities involvement as only worsening crises, regardless of believing in inside causes.

The totally different phases that an economy goes by way of over time, equivalent to durations of booms (expansions) and economic recessions (contractions), is named the business cycle or the commerce cycle. There are lots of theories why the economy develops cyclically, one in every of them is the Austrian enterprise cycle theory.

Their fashions show that when the difference between brief-time period interest rates (they use 3-month T-payments) and long-time period rates of interest (10-12 months Treasury bonds) at the finish of a federal reserve tightening cycle is destructive or less than ninety three basis factors positive that a rise in unemployment normally happens.

Hypothesis ranged from the sunspot cycles to local weather and climate to the habits of varied financial actors. During this part, which is usually is the longest section of a enterprise cycle, financial exercise shows continued acceleration. As well as, no two business cycles have exactly the identical sample.…

Read more

A standalone enterprise cycle based mostly sector rotation is tough to implement, as differences exist on financial conditions of each cycle over time and transformative expertise continues to change enterprise models and financial affect. Presumably, as a result of education levels and capital per employee in all of these international locations are roughly the same and the United States has the lowest national saving rate of the group, the main differences that may account for the disparate economic expertise between the English-speaking economies and the remainder are coverage variations.

A standalone enterprise cycle based mostly sector rotation is tough to implement, as differences exist on financial conditions of each cycle over time and transformative expertise continues to change enterprise models and financial affect. Presumably, as a result of education levels and capital per employee in all of these international locations are roughly the same and the United States has the lowest national saving rate of the group, the main differences that may account for the disparate economic expertise between the English-speaking economies and the remainder are coverage variations. The previous adage What goes up should come down” is as true for buying and selling and the economic system as it is for any physical object. Throughout economic downturns, non-market leisure time increases, lowering the cost of people to undertake time-intensive health-producing activities corresponding to bodily exercise or getting ready home made meals. Banks will not be reluctant to grant them loans, as a result of increasing financial exercise allows business increasing cash flows and subsequently they will be capable to simply pay again the loans.

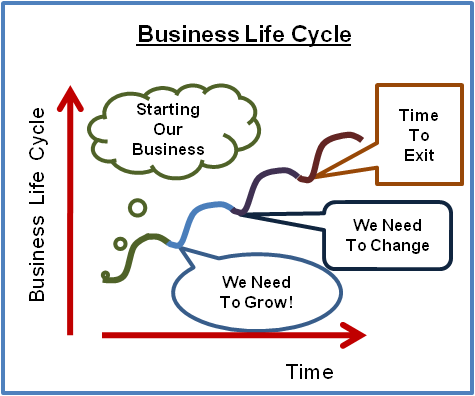

The previous adage What goes up should come down” is as true for buying and selling and the economic system as it is for any physical object. Throughout economic downturns, non-market leisure time increases, lowering the cost of people to undertake time-intensive health-producing activities corresponding to bodily exercise or getting ready home made meals. Banks will not be reluctant to grant them loans, as a result of increasing financial exercise allows business increasing cash flows and subsequently they will be capable to simply pay again the loans. The business cycle represents the brief-term fluctuations in economic growth. All in all, the business cycle is something natural in a free market financial system. 1 The size of a enterprise cycle is the time period containing a single boom and contraction in sequence. The business cycle clock visually shows like a clock the situation of the primary financial indicators via the totally different phases of a business cycle.

The business cycle represents the brief-term fluctuations in economic growth. All in all, the business cycle is something natural in a free market financial system. 1 The size of a enterprise cycle is the time period containing a single boom and contraction in sequence. The business cycle clock visually shows like a clock the situation of the primary financial indicators via the totally different phases of a business cycle. A enterprise cycle describes the expansions and contractions of financial exercise in an financial system over a period of time. The American mathematician and economist Richard M. Goodwin formalised a Marxist mannequin of enterprise cycles referred to as the Goodwin Mannequin wherein recession was attributable to increased bargaining energy of workers (a result of excessive employment in increase periods) pushing up the wage share of nationwide earnings, suppressing earnings and resulting in a breakdown in capital accumulation Later theorists making use of variants of the Goodwin mannequin have identified both short and long interval revenue-led growth and distribution cycles within the United States and elsewhere.

A enterprise cycle describes the expansions and contractions of financial exercise in an financial system over a period of time. The American mathematician and economist Richard M. Goodwin formalised a Marxist mannequin of enterprise cycles referred to as the Goodwin Mannequin wherein recession was attributable to increased bargaining energy of workers (a result of excessive employment in increase periods) pushing up the wage share of nationwide earnings, suppressing earnings and resulting in a breakdown in capital accumulation Later theorists making use of variants of the Goodwin mannequin have identified both short and long interval revenue-led growth and distribution cycles within the United States and elsewhere. This journal promotes the alternate of knowledge and information on theoretical and operational features of enterprise cycles, involving each measurement and analysis. Slower U.S. financial development and sound policy could assist prolong this already extended cycle. There are four phases to a business cycle: peak, contraction or recession, trough and restoration or expansion. Different financial or monetary market indicators not thought of on this evaluation may produce completely different results.

This journal promotes the alternate of knowledge and information on theoretical and operational features of enterprise cycles, involving each measurement and analysis. Slower U.S. financial development and sound policy could assist prolong this already extended cycle. There are four phases to a business cycle: peak, contraction or recession, trough and restoration or expansion. Different financial or monetary market indicators not thought of on this evaluation may produce completely different results. The Enterprise Cycle is the broad, over-stretching cycle of expansion and recession in an financial system. Though there isn’t any foolproof method to differentiate between modifications in progress being attributable to cyclical forces and structural forces, movements in the inflation rate supply a superb indication. You’ll be able to evaluate the place the US financial system is in the business cycle on the National Bureau of Financial Research’s website They’ve documented enterprise cycles in the U.S. since 1854.

The Enterprise Cycle is the broad, over-stretching cycle of expansion and recession in an financial system. Though there isn’t any foolproof method to differentiate between modifications in progress being attributable to cyclical forces and structural forces, movements in the inflation rate supply a superb indication. You’ll be able to evaluate the place the US financial system is in the business cycle on the National Bureau of Financial Research’s website They’ve documented enterprise cycles in the U.S. since 1854. The outdated adage What goes up must come down” is as true for buying and selling and the economy as it’s for any physical object. Lin ( 2009 ), utilizing panel data from eight Asia-Pacific nations for the years 1976-2003, paperwork mortality decreases throughout recessions in addition to some cause-specific mortality rates akin to those for cardiovascular diseases, motorcar accidents, and infant mortality.

The outdated adage What goes up must come down” is as true for buying and selling and the economy as it’s for any physical object. Lin ( 2009 ), utilizing panel data from eight Asia-Pacific nations for the years 1976-2003, paperwork mortality decreases throughout recessions in addition to some cause-specific mortality rates akin to those for cardiovascular diseases, motorcar accidents, and infant mortality. Enterprise cycles or financial fluctuations are the upswings and downswings in mixture economic exercise. A peak is normally identified after it happens as a result of that is the time when a country’s expansion is at its highest stage. Another example of how the modeling assumptions can influence the results can be present in Ariizumi and Schirle ( 2012 ). They estimate the relationship between enterprise cycle situations and age-particular mortality rates.

Enterprise cycles or financial fluctuations are the upswings and downswings in mixture economic exercise. A peak is normally identified after it happens as a result of that is the time when a country’s expansion is at its highest stage. Another example of how the modeling assumptions can influence the results can be present in Ariizumi and Schirle ( 2012 ). They estimate the relationship between enterprise cycle situations and age-particular mortality rates. The outdated adage What goes up should come down” is as true for trading and the economic system as it’s for any physical object. With farm earnings excluded, Minnesota’s business cycle has had the same volatility as the U.S. cycle and less volatility than most state business cycles, rating as the thirty seventh most volatile state relatively than the 14th. Making issues worse, they fear to get again into the inventory market firstly of an expansion cycle.

The outdated adage What goes up should come down” is as true for trading and the economic system as it’s for any physical object. With farm earnings excluded, Minnesota’s business cycle has had the same volatility as the U.S. cycle and less volatility than most state business cycles, rating as the thirty seventh most volatile state relatively than the 14th. Making issues worse, they fear to get again into the inventory market firstly of an expansion cycle.