In this blog post, I’ll examine the differences between investment books and investment seminars as a source of financial information to help inform your trades and your financial planning.

We’ll begin by looking at what investing books and seminars actually are; what they typically look like as a proposition to the investor. This will include factors like price, location, level of detail and so on.

Next we’ll think about the needs of the modern day investor. What type of financial education is actually worth paying for, and which of these educational formats bests serves that need?

Finally, we’ll consider any externalities of these learning methods. Are there other consequences of restricting our learning to just one medium which we should take away?

Finally, we’ll conclude which is the superior educational method: the best investing books or the best investing seminars.

What are investing books

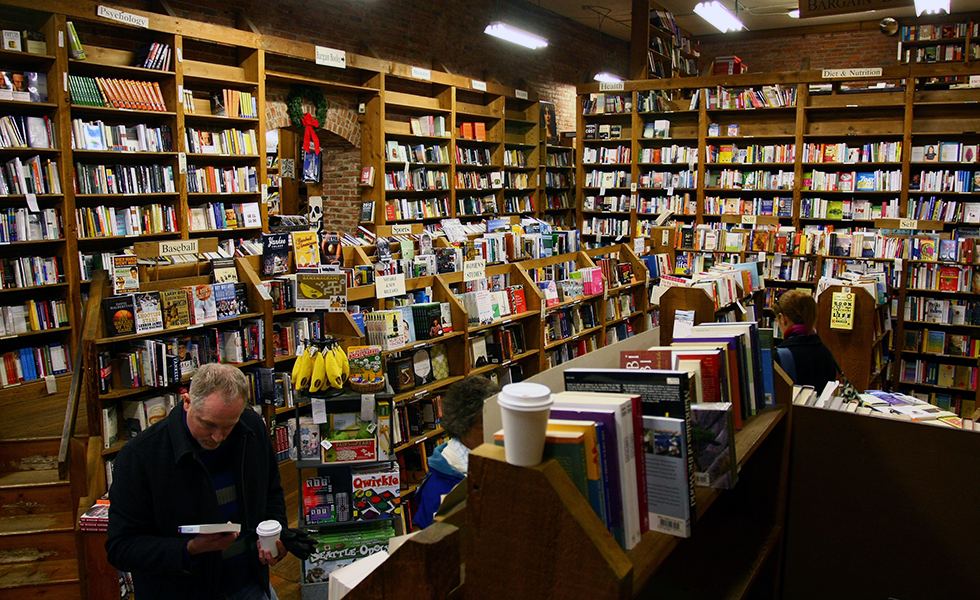

Investing books are published titles issued by the large publishing houses. I will not include the recent ‘ebook’ phenomenon which has seen online book stores flooded with many poorer quality and cheaper titles. When I refer to investing books, I mean the best sellers in their class – tried and tested paperbacks or hardbacks which have imparted information to investors for several years at least.

I do not include financial magazines or financial journalism in this category. While these are honourable formats, and their authors are often very knowledgeable and have a credible level of experience and insight – the objective of this writing is subtly different to investment books.

A magazine is generally trying to produce the paper-equivalent of ‘clickbait’, i.e. catchy bitesize pieces of information that tempts a reader into purchasing a copy.

Financial news is concerned with high volume, and doesn’t often attempt to distill themes and information into actionable principles. A newspaper isn’t trying to advise its readers, nor it is trying to teach them how to invest. This is why I don’t hold them up to the same standard as investing books in this review.

What are investing seminars?

Investment seminars are short courses, held in a physical class format or as an online streamable session. Webinars are typically only a single class. Multiple webinars held on a single day are often known as a conference, particularly when the day features multiple speakers not directly employed by the conference organiser.

I’ll distinguish investment seminars from investing courses, which tend to run for longer periods of time, such as 10 sessions over 10 weeks. Investing courses also include a higher level of ‘self-study’ and revision/course work which means that the total time requirement is much greater than the length of time listening to the classes themselves.

I am not including investing courses in this article because their cost is significantly higher than investing books – and therefore it doesn’t lead to a fair comparison. Investment seminars, being often just 3 hours long, are often marketed at prices which equate to a small stack of investing books, so they’re within the realms of comparability.

What are the needs of modern investors

Modern investors, unlike those of 200 years ago, will usually have a full time job, and will be using the surplus savings from those paychecks to fund the investments. Therefore time is a major constraint, and the investor will want to both:

- Learn quickly

- Learn an investing approach which won’t require time-intensive monitoring

Both investment books and investing seminars fit the bill in this regard. A book can be picked up and put down to suit the investors slots of free time – they’re perfect for a commute (if the investor uses public transport). Investment seminars are less flexible, but are usually held in the evening or on a weekend. They’re like a ‘crash course’ therefore try to pack as much information into the session as possible.

What else should be considered?

A final consideration worth taking into account is the motivation behind the service you’re receiving.

An investment book author intends to sell a high volume of books – they know this can only be possible if the book is well-reviewed and spreads well through word of mouth, as investment books don’t receive promotional/marketing spend from their publishers unless the author is extremely well known and this is likely to produce a good return.

A seminar organiser potentially has some motivations which run counter to the investor. The seminar organiser will have the incentive of upselling their captive audience onto a more expensive or longer seminar series – here’s an example. Often, an investment seminar is little more than a bit of content spread on top of a large sales pitch for a seminar which may cost in excess of £1,000.

For this reason, I conclude that investment books are the superior format, as they have a pure purpose and are very flexible. Seminars have their place, for sure, but to reduce the risk of turning up to a glorified sales pitch – ensure that the price offered is reasonable for the level of production involved. For example – if the seminar lasts half a day and only costs £15 to attend – this is a red flag.